Source link : https://health365.info/taxpayers-spend-22-extra-in-line-with-affected-person-to-beef-up-medicare-benefit-the-personal-selection-to-medicare-that-promised-to-price-much-less/

Medicare Benefit – the economic selection to conventional Medicare – is drawing down federal well being care price range, costing taxpayers an additional 22% in line with enrollee to the song of US$83 billion a 12 months.

Medicare Benefit, often referred to as Phase C, was once intended to save lots of the govt. cash. The contest amongst personal insurance coverage firms, and with conventional Medicare, to control affected person care was once intended to present insurance coverage firms an incentive to search out efficiencies. As an alternative, this system’s cost regulations overpay insurance coverage firms at the taxpayer’s dime.

We’re well being care coverage mavens who find out about Medicare, together with how the construction of the Medicare cost device is, when it comes to Medicare Benefit, running towards taxpayers.

Medicare beneficiaries make a selection an insurance coverage plan after they flip 65. More youthful folks too can transform eligible for Medicare because of continual stipulations or disabilities. Beneficiaries have a number of choices, together with the standard Medicare program administered by means of the U.S. authorities, Medigap dietary supplements to that program administered by means of personal firms, and all-in-one Medicare Benefit plans administered by means of personal firms.

Business Medicare Benefit plans are an increasing number of well-liked – over part of Medicare beneficiaries are enrolled in them, and this percentage continues to develop. Individuals are attracted to those plans for his or her further advantages and out-of-pocket spending limits. However because of a loophole in maximum states, enrolling in or switching to Medicare Benefit is successfully a one-way side road. The Senate Finance Committee has additionally discovered that some plans have used misleading, competitive and doubtlessly damaging gross sales and advertising and marketing ways to extend enrollment.

Baked into the plan

Researchers have discovered that the overpayment to Medicare Benefit firms, which has grown through the years, was once, deliberately or now not, baked into the Medicare Benefit cost device. Medicare Benefit plans are paid extra for enrolling individuals who appear sicker, as a result of those folks in most cases use extra care and so could be dearer to hide in conventional Medicare.

On the other hand, variations in how folks’s diseases are recorded by means of Medicare Benefit plans reasons enrollees to appear sicker and more expensive on paper than they’re in actual lifestyles. This factor, along different changes to funds, ends up in overpayment with taxpayer bucks to insurance coverage firms.

A few of this additional cash is spent to cheaper price sharing, decrease prescription drug premiums and build up supplemental advantages like imaginative and prescient and dental care. Even though Medicare Benefit enrollees would possibly like those advantages, investment them this manner is costly. For each and every further buck that taxpayers pay to Medicare Benefit firms, most effective kind of 50 to 60 cents is going to beneficiaries within the type of decrease premiums or further advantages.

As Medicare Benefit turns into an increasing number of dear, the Medicare program continues to stand investment demanding situations.

In our view, to ensure that Medicare to live to tell the tale longer term, Medicare Benefit reform is wanted. The way in which the govt. can pay the personal insurers who administer Medicare Benefit plans, which would possibly appear to be a black field, is vital to why the govt. overpays Medicare Benefit plans relative to conventional Medicare.

Paying Medicare Benefit

Non-public plans were part of the Medicare device since 1966 and feature been paid via a number of other programs. They garnered just a very small percentage of enrollment till 2006.

The present Medicare Benefit cost device, carried out in 2006 and closely reformed by means of the Reasonably priced Care Act in 2010, had two coverage targets. It was once designed to inspire personal plans to supply the similar or higher protection than conventional Medicare at equivalent or lesser charge. And, to verify beneficiaries would have a couple of Medicare Benefit plans to choose between, the device was once additionally designed to be winning sufficient for insurers to trap them to supply a couple of plans during the rustic.

To perform this, Medicare established benchmark estimates for each and every county. This benchmark calculation starts with an estimate of what the government-administered conventional Medicare plan would spend at the moderate county resident. This price is adjusted in line with a number of components, together with enrollee location and plan high quality scores, to present each and every plan its personal benchmark.

Medicare Benefit plans then publish bids, or estimates, of what they be expecting their plans to spend at the moderate county enrollee. If a plan’s spending estimate is above the benchmark, enrollees pay the adaptation as a Phase C top rate.

Maximum plans’ spending estimates are under the benchmark, then again, that means they undertaking that the plans will supply protection this is an identical to conventional Medicare at a cheaper price than the benchmark. Those plans don’t price sufferers a Phase C top rate. As an alternative, they obtain a portion of the adaptation between their spending estimate and the benchmark as a rebate that they’re intended to move directly to their enrollees as extras, like discounts in cost-sharing, decrease prescription drug premiums and supplemental advantages.

In spite of everything, in a procedure referred to as menace adjustment, Medicare funds to Medicare Benefit well being plans are adjusted in line with the well being in their enrollees. The plans are paid extra for enrollees who appear sicker.

The federal government can pay Medicare Benefit plans in line with Medicare’s charge estimates for a given county. The benchmark is an estimate from the Facilities for Medicare & Medicaid Products and services of what it will charge to hide a mean county enrollee in conventional Medicare, plus changes together with quartile funds and high quality bonuses. The chance-adjusted benchmark additionally takes under consideration an enrollee’s well being.

Samantha Randall at USC, CC BY-ND

Idea as opposed to fact

In principle, this cost device will have to save the Medicare device cash since the risk-adjusted benchmark that Medicare estimates for each and every plan will have to run, on moderate, equivalent to what Medicare would if truth be told spend on a plan’s enrollees if that they had enrolled in conventional Medicare as a substitute.

In truth, the risk-adjusted benchmark estimates are some distance above conventional Medicare prices. This reasons Medicare – in point of fact, taxpayers – to spend extra for each and every one that is enrolled in Medicare Benefit than if that individual had enrolled in conventional Medicare.

Why are cost estimates so prime? There are two major culprits: benchmark changes designed to inspire Medicare Benefit plan availability, and menace changes that overestimate how in poor health Medicare Benefit enrollees are.

Top risk-adjusted benchmarks result in overpayments from the govt. to the personal firms that administer Medicare Benefit plans.

Samantha Randall at USC, CC BY-ND

Benchmark changes

For the reason that present Medicare Benefit cost device began in 2006, policymaker changes have made Medicare’s benchmark estimates much less tied to what the plan spends on each and every enrollee.

In 2012, as a part of the Reasonably priced Care Act, Medicare Benefit benchmark estimates won every other layer: “quartile adjustments.” Those made the benchmark estimates, and due to this fact funds to Medicare Benefit firms, greater in spaces with low conventional Medicare spending and decrease in spaces with prime conventional Medicare spending. This benchmark adjustment was once intended to inspire extra equitable get right of entry to to Medicare Benefit choices.

In that very same 12 months, Medicare Benefit plans began receiving “quality bonus payments” with plans that experience greater “star ratings” in line with high quality components comparable to enrollee well being results and take care of continual stipulations receiving greater bonuses.

On the other hand, analysis displays that scores have now not essentially advanced high quality and could have exacerbated racial inequality.

Even prior to totally allowing for menace adjustment, fresh estimates peg the benchmarks, on moderate, as 8% greater than moderate conventional Medicare spending. Which means that a Medicare Benefit plan’s spending estimate might be under the benchmark and the plan would nonetheless receives a commission extra for its enrollees than it will have charge the govt. to hide those self same enrollees in conventional Medicare.

Overestimating enrollee illness

The second one primary supply of overpayment is well being menace adjustment, which has a tendency to overestimate how in poor health Medicare Benefit enrollees are.

Every 12 months, Medicare research conventional Medicare diagnoses, comparable to diabetes, melancholy and arthritis, to know that have greater remedy prices. Medicare makes use of this data to regulate its funds for Medicare Benefit plans. Bills are diminished for plans with decrease predicted prices in line with diagnoses and raised for plans with greater predicted prices. This procedure is referred to as menace adjustment.

However there’s a crucial bias baked into menace adjustment. Medicare Benefit firms know that they’re paid extra if their enrollees appear extra in poor health, so that they diligently be sure each and every enrollee has as many diagnoses recorded as imaginable.

It will come with criminal actions like reviewing enrollee charts to make certain that diagnoses are recorded correctly. It may well additionally every so often entail outright fraud, the place charts are “upcoded” to incorporate diagnoses that sufferers don’t if truth be told have.

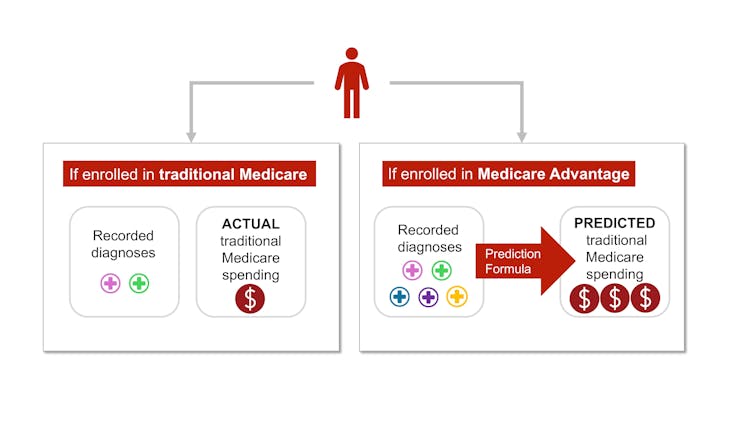

In conventional Medicare, maximum suppliers – the exception being Responsible Care Organizations – aren’t paid extra for recording diagnoses. This distinction implies that the similar beneficiary is more likely to have fewer recorded diagnoses if they’re enrolled in conventional Medicare fairly than a personal insurer’s Medicare Benefit plan. Coverage mavens check with this phenomenon as a distinction in “coding intensity” between Medicare Benefit and conventional Medicare.

The similar individual could be documented with extra diseases in the event that they join in Medicare Benefit fairly than conventional Medicare – and price taxpayers more cash.

Samantha Randall at USC, CC BY-ND

As well as, Medicare Benefit plans regularly attempt to recruit beneficiaries whose well being care prices will probably be less than their diagnoses would expect, comparable to somebody with an overly gentle type of arthritis. That is referred to as “favorable selection.”

The variations in coding and favorable variety make beneficiaries glance sicker after they join in Medicare Benefit as a substitute of conventional Medicare. This makes charge estimates greater than they will have to be. Analysis displays that this mismatch – and ensuing overpayment – is most probably most effective going to worsen as Medicare Benefit grows.

The place the cash is going

One of the vital extra funds to Medicare Benefit are returned to enrollees via further advantages, funded by means of rebates. Further advantages come with cost-sharing discounts for hospital therapy and pharmaceuticals, decrease Phase B and D premiums, and additional “supplemental benefits” like listening to aids and dental care that conventional Medicare doesn’t quilt.

Medicare Benefit enrollees would possibly experience those advantages, which might be regarded as a praise for enrolling in Medicare Benefit, which, not like conventional Medicare, has prior authorization necessities and restricted supplier networks.

On the other hand, in accordance to a few coverage mavens, the present ability of investment those further advantages is unnecessarily dear and inequitable.

It additionally makes it tough for normal Medicare to compete with Medicare Benefit.

Conventional Medicare, which has a tendency to price the Medicare program much less in line with enrollee, is most effective allowed to give you the same old Medicare advantages bundle. If its enrollees need dental protection or listening to aids, they have got to buy those one after the other, along a Phase D plan for pharmaceuticals and a Medigap plan to decrease their deductibles and co-payments.

Medicare Benefit plans be offering extras, however at a prime charge to the Medicare device – and taxpayers. Handiest 50-60 cents of a buck spent is returned to enrollees as diminished prices or higher advantages.

AP Picture/Pablo Martinez Monsivais

The device units up Medicare Benefit plans not to most effective be overpaid but additionally be an increasing number of well-liked, all at the taxpayers’ dime. Plans closely market it to potential enrollees who, as soon as enrolled in Medicare Benefit, will most probably have issue switching into conventional Medicare, although they come to a decision the additional advantages aren’t definitely worth the prior authorization hassles and the restricted supplier networks. Against this, conventional Medicare in most cases does now not have interaction in as a lot direct promoting. The government most effective accounts for 7% of Medicare-related commercials.

On the identical time, some individuals who want extra well being care and are having bother getting it via their Medicare Benefit plan – and are in a position to modify again to conventional Medicare – are doing so, in line with an investigation by means of The Wall Side road Magazine. This leaves taxpayers to pick out up take care of those sufferers simply as their wishes upward thrust.

The place will we pass from right here?

Many researchers have proposed techniques to cut back extra authorities spending on Medicare Benefit, together with increasing menace adjustment audits, lowering or getting rid of high quality bonus funds or the use of extra knowledge to enhance benchmark estimates of enrollee prices. Others have proposed much more basic reforms to the Medicare Benefit cost device, together with converting the root of plan funds in order that Medicare Benefit plans will compete extra with each and every different.

Decreasing funds to plans would possibly must be traded off with discounts in plan advantages, although projections counsel the discounts could be modest.

There’s a long-running debate over what form of protection will have to be required below each conventional Medicare and Medicare Benefit. Not too long ago, coverage mavens have advocated for introducing an out-of-pocket most to conventional Medicare. There have additionally been a couple of unsuccessful efforts to make dental, imaginative and prescient, and listening to services and products a part of the usual Medicare advantages bundle.

Even supposing all older folks require common dental care and plenty of of them require listening to aids, offering those advantages to everybody enrolled in conventional Medicare would now not be affordable. One option to offering those vital advantages with out considerably elevating prices is to make those advantages means-tested. This may permit folks with decrease earning to buy them at a cheaper price than higher-income folks. On the other hand, means-testing in Medicare may also be debatable.

There could also be debate over how a lot Medicare Benefit plans will have to be allowed to change. The common Medicare beneficiary has over 40 Medicare Benefit plans to choose between, making it overwhelming to check plans. As an example, at the moment, the common individual eligible for Medicare must sift in the course of the superb print of dozens of various plans to check vital components, comparable to out-of-pocket maximums for hospital therapy, protection for dental cleanings, cost-sharing for inpatient remains, and supplier networks.

Even supposing hundreds of thousands of individuals are in suboptimal plans, 70% of folks don’t even examine plans, let on my own transfer plans, throughout the yearly enrollment length on the finish of the 12 months, most probably since the technique of evaluating plans and switching is hard, particularly for older American citizens.

MedPAC, a congressional advising committee, means that proscribing variation in sure vital advantages, like out-of-pocket maximums and dental, imaginative and prescient and listening to advantages, may lend a hand the plan variety procedure paintings higher, whilst nonetheless taking into account flexibility in different advantages. The problem is determining methods to standardize with out unduly lowering shoppers’ choices.

The Medicare Benefit program enrolls over part of Medicare beneficiaries. On the other hand, the $83-billion-per-year overpayment of plans, which quantities to greater than 8% of Medicare’s overall finances, is unsustainable. We imagine the Medicare Benefit cost device wishes a extensive reform that aligns insurers’ incentives with the desires of Medicare beneficiaries and American taxpayers.

This newsletter is a part of an occasional sequence analyzing the U.S. Medicare device.

Previous articles within the sequence:

Medicare vs. Medicare Benefit: gross sales pitches are regularly from biased resources, the selections may also be overwhelming and independent lend a hand isn’t similarly to be had to all

Author : admin

Publish date : 2024-11-26 14:12:53

Copyright for syndicated content belongs to the linked Source.