The price of residing disaster, which noticed inflation in the USA height at a four-decade prime of 9.1% in 2022, performed an important function in figuring out the result of final November’s presidential election.

Go out polls throughout ten of the important thing battleground states confirmed 32% of electorate thought to be the financial system to be an important election factor. Amongst that staff of electorate, a staggering 81% voted for Donald Trump.

Trump had spent maximum of his election marketing campaign announcing his management would take on prime costs – even vowing to carry them down on day one. Alternatively, the most recent figures counsel inflation in the USA has larger since he took workplace, emerging all of a sudden to a six-month prime of three% in January.

This upward push is in large part as a result of the financial system Trump inherited. However some mavens have expressed issues that his said financial technique, together with business price lists, main tax cuts and decrease rates of interest, will best upload to inflation.

Whilst tax cuts and rate of interest adjustments are acquainted insurance policies, the usage of price lists has been much less commonplace in contemporary a long time. Those are utilized by governments to stability business relationships or in retaliation to price lists imposed via different international locations. They most often make overseas imported items dearer whilst additionally elevating tax revenues for governments.

The Trump management has set price lists of 25% on all metal and aluminium imports, and imposed 10% business price lists on a variety of shopper imports from China. Whilst proposed price lists of 25% on imports from Mexico and Canada were briefly paused, the USA has signalled its goal to introduce price lists on imports from the Eu Union.

A Normal Motors automotive meeting facility in Ontario, Canada, the place economists expect the proposed price lists would have a catastrophic impact.

JHVEPhoto / Shutterstock

Will price lists result in inflation?

Trump’s aides insist the price lists received’t have a damaging have an effect on on American customers and companies. On February 18, Peter Navarro, senior suggest for business and production on the White Space, instructed the New York Instances: “It’s not going to be painful for America. It’s going to be a beautiful thing.”

Navarro argues that overseas exporters, interested by shedding marketplace percentage, will scale back the pre-tariff value they price US importers.

However financial idea means that price lists most often do result in upper costs. Peter Lavelle, a business professional at the United Kingdom’s Institute for Fiscal Research, says that proof from Trump’s first time period – when price lists have been imposed on sun panels, washing machines, metal and aluminium – displays those prices have been “almost entirely passed on to domestic consumers”, thus including to inflation.

A key explanation why for the price lists is to make US home production extra aggressive at the global degree. This is able to carry production jobs again to the USA. Production employment declined via 35% in the USA from its height of nineteen.6 million in 1979 to twelve.8 million in 2020.

Alternatively, there used to be no proof of price lists bringing production jobs again to the USA throughout Trump’s first time period. In reality, production employment remained static between 2017 and 2021.

There are fears that price lists may as a substitute cause a business battle, the place international locations retaliate with price lists of their very own. Canadian officers, for example, have made it transparent they are going to introduce retaliatory price lists on the USA – “selected in order to hit particularly red and purple [Trump-supporting] states”.

Economists analyse such eventualities the usage of recreation idea. A business battle takes the type of what economics-speak calls a “non-cooperating Nash equilibrium”, the place the industrial consequence is damaging for all international locations concerned.

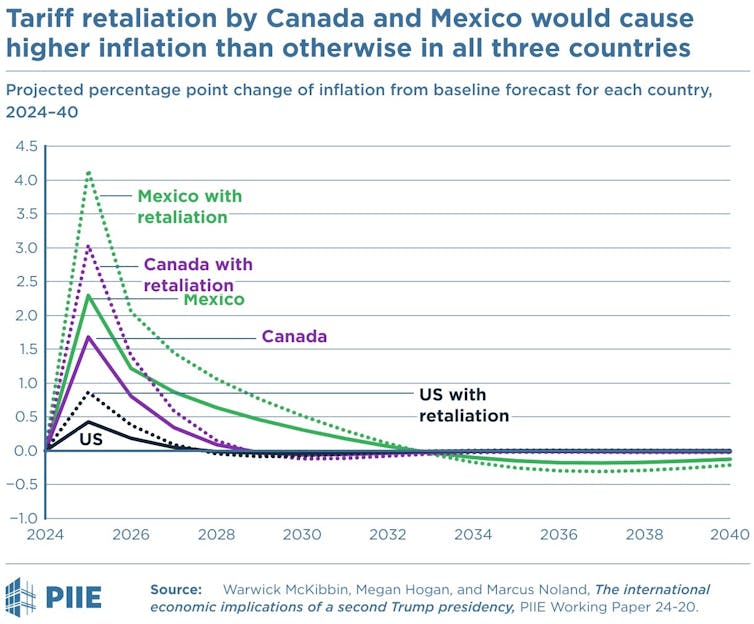

Some contemporary modelling at the have an effect on of Trump’s proposed price lists on Canada and Mexico helps this view. Tariff retaliation is more likely to lift inflation charges even additional than another way in all 3 economies.

A business battle may additionally squeeze benefit margins for exporting manufacturers in the USA, via making some US-produced items rather dearer. This is able to display up in decrease actual source of revenue thru diminished employment and wages. This consequence, like upper costs, is not going to be well liked by US electorate.

Given the proof from Trump’s first time period, it’s tough to look how price lists will likely be anything else however inflationary. Trump’s proposed tax cuts valued at US$5-11 trillion would additionally upload to inflationary pressures, as would the decrease rates of interest he has referred to as for.

Ana Swanson, a business and global economist on the New York Instances, believes the specter of price lists is getting used simply as a negotiating technique. Alternatively, like many different economists, Swanson sees uncertainty as the most important have an effect on of Trump’s tariff coverage.

In a podcast on February 4, she mentioned: “If you, as the business, are watching out for the threat of tariffs, are you going to make an investment in a new factory or hire new workers?” Uncertainty ends up in diminished funding and decrease expansion.

Realistically, Trump used to be by no means going to carry down costs for US customers. To do this could be deflationary, and economists most often concern deflation much more than inflation. Falling costs result in deferred spending and will also be devastating for financial expansion.

The most productive consequence for US customers is that costs building up at a slower fee, as regards to the USA Federal Reserve’s inflation goal of two%. Alternatively, given the new uptick in inflation, in addition to Trump’s process of price lists, tax cuts and decrease rates of interest, the route of shuttle all issues in opposition to upper value rises.

Fresh proof from elections in lots of complicated economies displays that electorate don’t like inflation, and can punish administrations who’re in energy throughout inflationary sessions.

Since inflation peaked in lots of complicated economies in 2022, greater than 70% of incumbent administrations were voted out of presidency. Trump must stay this in thoughts as he embarks on his quest to make The us’s financial system nice once more.

Author : donald-trump

Publish date : 2025-02-28 21:09:00

Copyright for syndicated content belongs to the linked Source.